29 (2) refers to “force and fear” equivalent to the common term “duress”-See Chalmers,, Bills of Exchange 13th ed. The more familiar expression is “equity attaching to the bill”, but as the latter expression is unknown in Scottish law the English legislator added the former. 29 and other sections of the English Act. note 6 Expressions appearing in the English Act are sometimes copied although unknown in the copying legal system. A monolithic system was thus created, based on a literal interpretation of the Act. Whenever called upon to construe the Act, the English courts have usually interpreted it literally, with strict adherence to the letter of the law, and this interpretation was followed by other courts, whether by reason of the binding force of precedents or in order to maintain uniformity in the law. Indeed, the drafting is clear and effective and has given rise to comparatively little litigation both in England and abroad. Both in England and in countries which adopted the statute only few amendments have been made, thereby lending weight to Mackinon L.J's dictum that the English Bills of Exchange Act is the best law ever enacted by the British Parliament. In 1882 the law in England was cast in statutory form and this was copied in toto, with minor changes, by many legal systems, including Canada, Australia, New Zealand, South Africa, Ceylon, Cyprus and Palestine. Notwithstanding the great number of decided cases, the law was mostly uniform, owing to the judges' inclination to follow rulings given by their brethren and their desire to retain the uniformity of customary mercantile law. These decisions were based on the custom of merchants-whether in England or abroad-and on the writings of jurists from commercially advanced countries. The groundwork consists of over 2,500 cases concerning bills decided in England since 1602, when the first case on bills was decided by the common law courts.

It helps to mobilise large amount of money for short period.The development of the law relating to bills of exchange in the Anglo-American legal system provides an instructive example of the interdependence of the judicial and legislative functions in legal development.

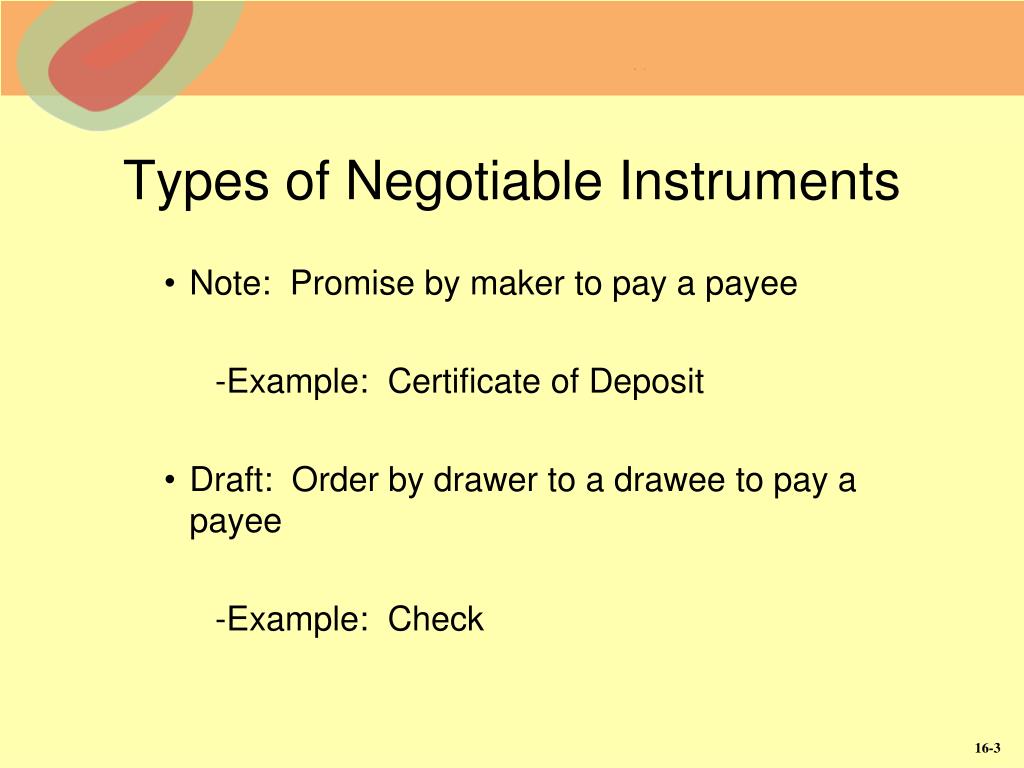

The tenure ranges from 91 days to one year. It is issued by the banks against deposits kept by companies and institutions. v Certificate of Deposit: They are unsecured short-term negotiable instruments issued in bearer form. The original purpose of commercial paper is to provide short-term funds for seasonal and working capital. Since a CP is unsecured it is issued only by a highly creditworthy reputed leading firms. iv Commercial Paper: A commercial paper is an unsecured promissory note issued by a corporate firm with a fixed maturity period which varies from 15 days to 12 months. It is known as commercial bill after acceptance of the trade bill by a Commercial Bank. If sellers require funds before the maturity he can get it discounted with the bank. They are self liquidating as the drawee has to honour them on the date of maturity. iii Trade Bills/Commercial Bills: Trade bills are bills drawn by one business firm on another to finance credit sales. They are issued at a discount and redeemable at par. The issue period ranges from 14 to 364 days. It is primarily used by Commercial Banks to maintain a minimum cash balance known as cash reserve ratio CRR as stipulated by the RBI.ii Treasury Bills: Treasury bills T-Bills are issued by the Reserve Bank of India on behalf of the government of India as a short-term liability and sold to the banks and to the public.

Answer : i Call Money: Call money is short-term finance repayable on demand with a maturity period of one day to fifteen days used for inter-bank transactions.

0 kommentar(er)

0 kommentar(er)